Step by step guide to managing UK VAT changes

Sorry, we can't find anything

- Articles

- Topics

- FAQ

Overview

MANAGING VAT CHANGES IN ELINA

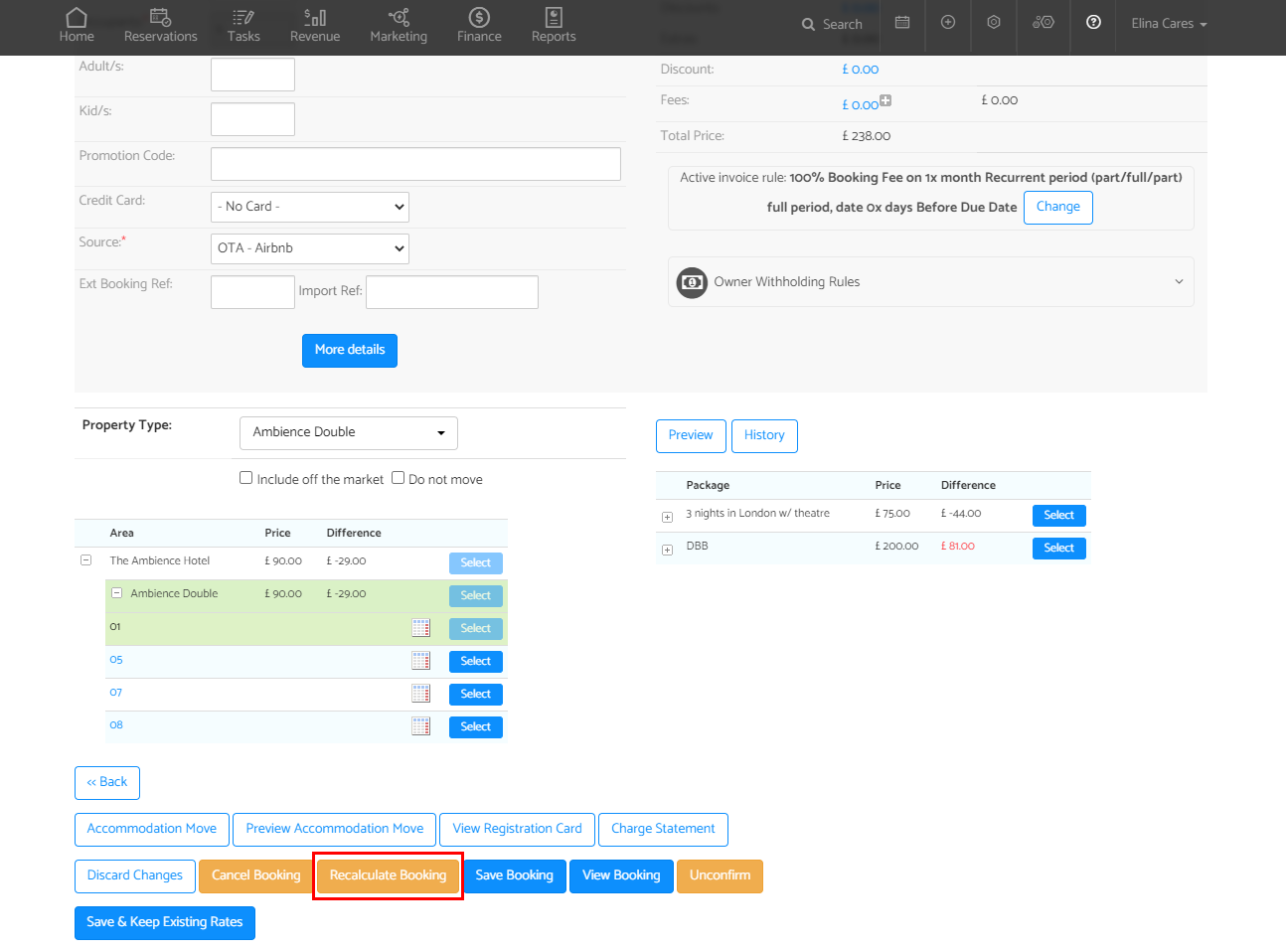

CHANGING VAT ON EXISTING RESERVATIONS IN ELINA

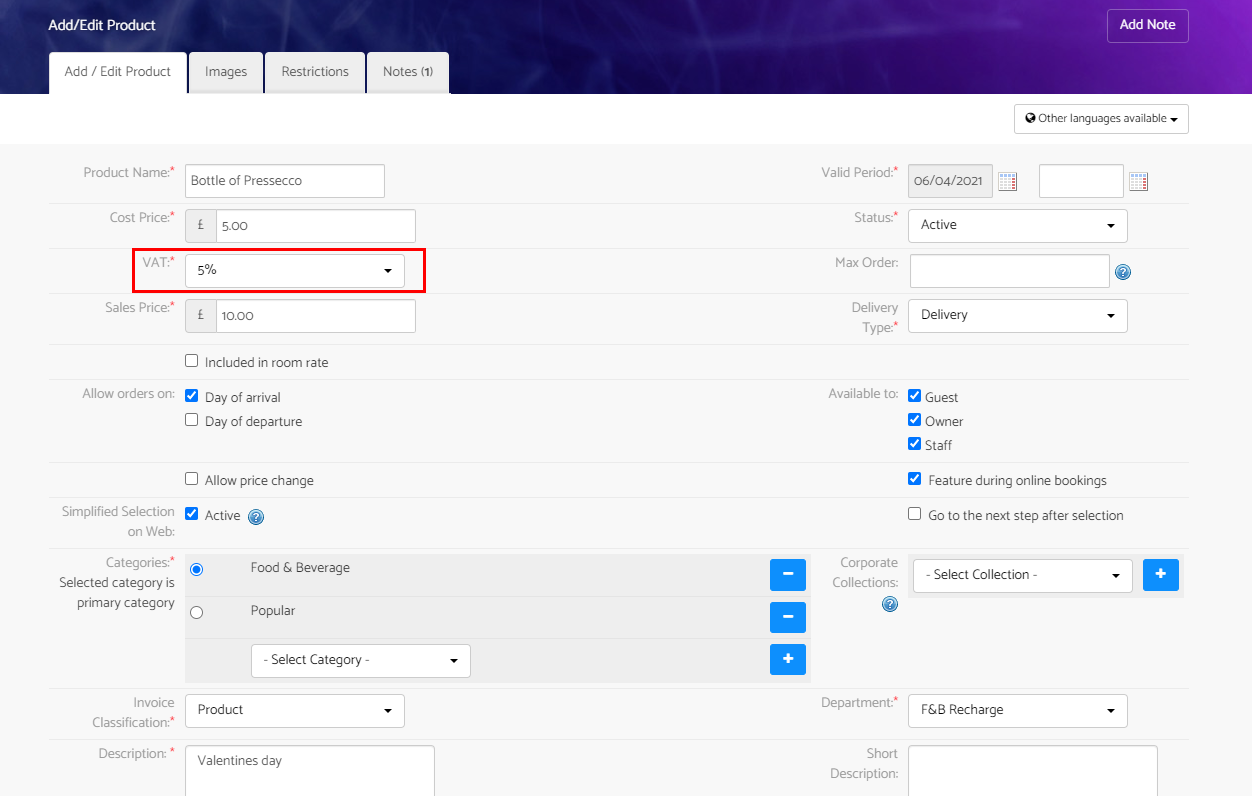

UPDATING VAT ON ADD ONS

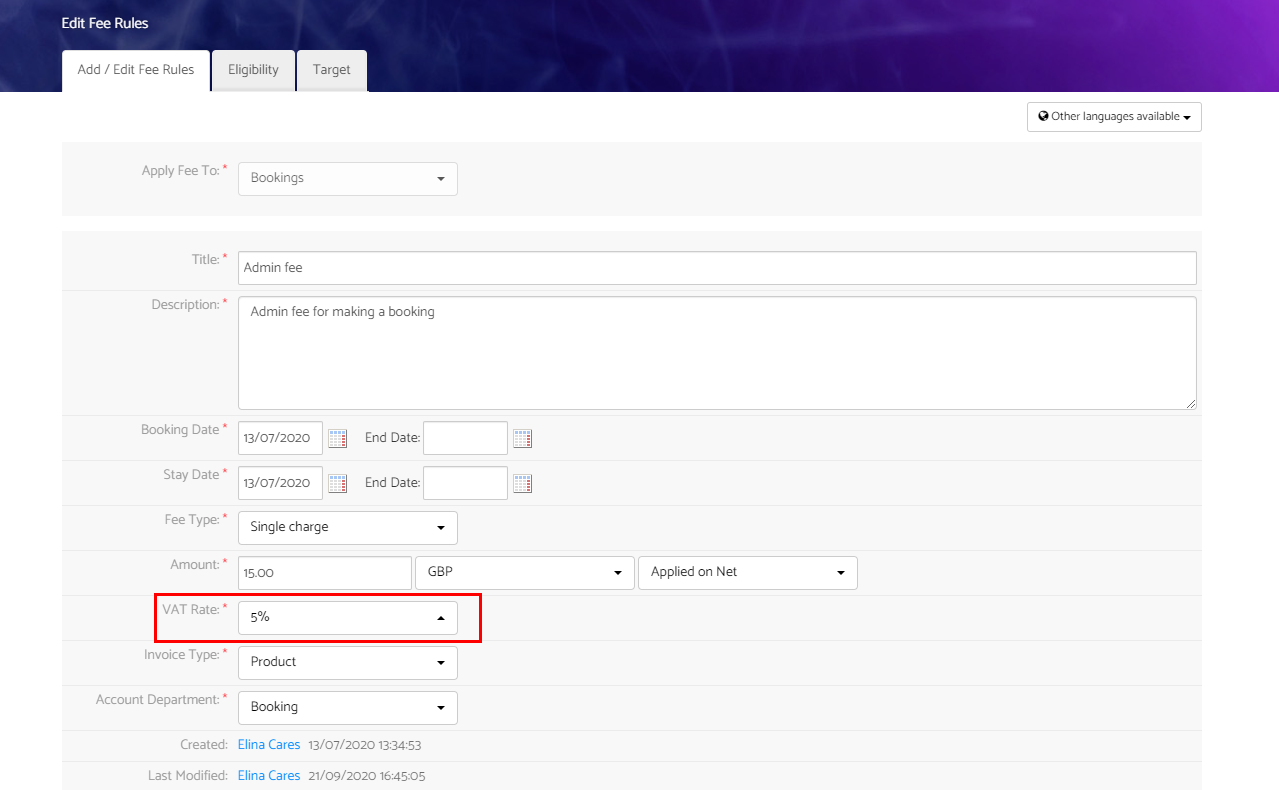

UPDATING VAT ON FEES

ADDITIONAL IMPORTANT INFORMATION

FAQS

Q) What permissions do I need to see this button?

A) You need to have the edit booking permission enabled. If it is not, ask your settings manager.

-

Q) When do we need to do this?

A) On of after the 15 July 2020 for Uk businesses.

-

Q)

-

How to do VAT changes for past reservations?

A) Please refer to our FAQ here

-

Q) What happens when there is existing credit on the guest /company profile?

A) Please refer to our FAQ here